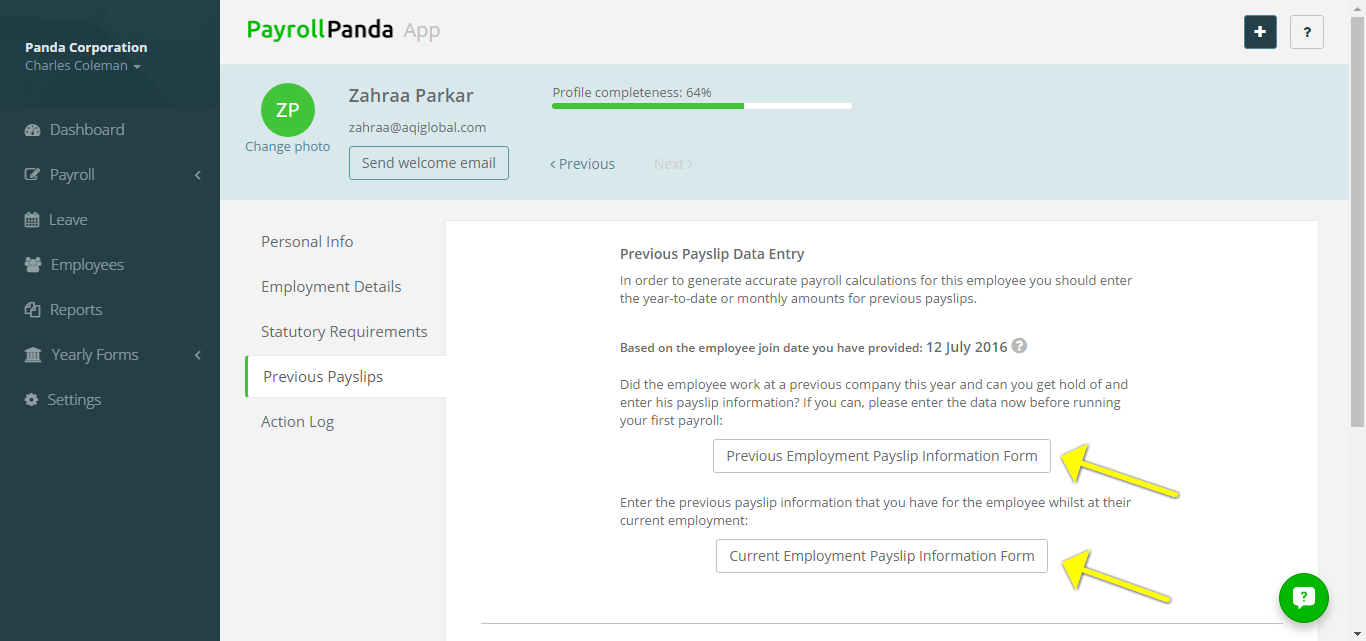

Current Employment Payslip Information Form

If you are running your first payroll with PayrollPanda, you will need to enter the current year previous payslip information for each of your staff under the Current Employment Payslip Information Form. Ensuring that you add previous payslip data is necessary for accurate PCB calculations and for E/EA form purposes.

You can either use our bulk upload feature to upload the previous salary information, (How to bulk upload previous payslip information for employees?) or key it in for each staff individually.

Previous Employment Payslip Information Form

If an employee joins your company during the year, it is an LHDN requirement that you obtain form TP3 from that employee. The form provides details of any employment income received, deductions claimed and contributions paid, while employed by any previous employers during the current year.

The information provided in the TP3 form should be entered under the Previous Employment Payslip Information Form. You need to add that data before including the employee in their first payroll to ensure accurate PCB calculations. For more details, you can read how to fill in the Previous Employment Payslip Information Form based on the TP3 information article.

Employees > Select Employee > Previous Payslips > Previous Employment Payslip Information Form OR Current Employment Payslip Information Form

This help article was compiled for version 0.8.21 of app.payrollpanda.my