EPF

You do not need to submit any special forms to KWSP if an employee is leaving your company. However, you must inform KWSP if you are temporarily or permanently not employing any workers. For more information, please refer to this KWSP link.

SOCSO/EIS

The employee's resignation date can be updated in Assist Portal. Please follow the steps in Assist Portal User Guide (p.72).

LHDN

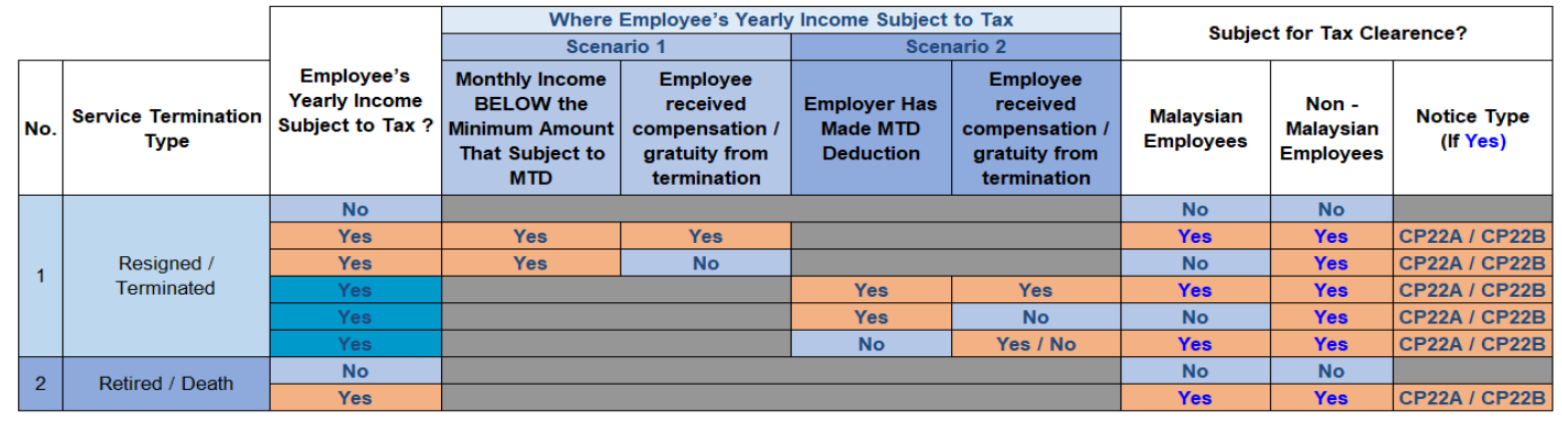

You are required to notify LHDN at least 30 days in advance by submitting Form CP22A and you must withhold any money payable to the employee until you receive a clearance letter from the LHDN, in the following cases:

- The employee is about to retire; or

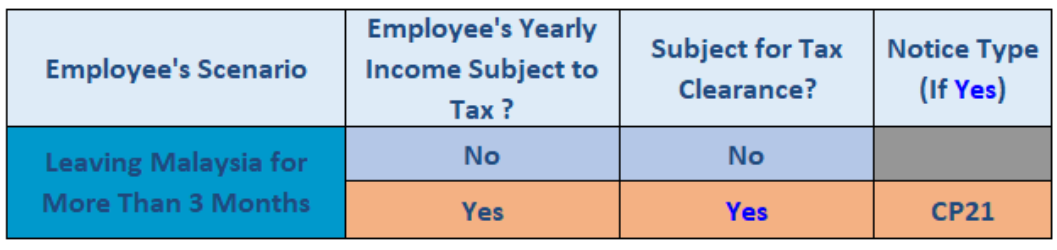

- The employee is about to leave Malaysia permanently (in this case Form CP21 would be submitted instead of Form CP22A); or

- The employee was eligible for PCB but no deductions were made.

From 1 January 2024, Form CP22A / CP22B is mandatory to be submitted online through MyTax portal using e-SPC application.

If you fail to do so, you are liable to prosecution and if convicted, liable to a fine of not less than RM200 and not more than RM2,000 or to imprisonment for a term not exceeding six months or to both.

You will also be responsible for any tax due from the employee.

In other cases, for example:

- The PCB was deducted correctly; or

- The employee’s salary was below the PCB threshold; and

- You are aware that the employee will continue working in Malaysia.

Then, there is no need to notify LHDN or withhold money payable to the employee. LHDN have advised to keep a signed confirmation of the employee's new employment in case of a PCB audit.