CP38 deductions are only necessary when LHDN issues a specific direction to the employer, asking them to make additional deductions in monthly installments from the salary of the taxpayer so that they may settle the employee's income tax arrears from previous years.

Instead of having to pay one lump sum, the employee is given the opportunity to settle their income tax arrears over a period of a few months rather than being burdened with one large deduction. Monthly PCB deductions continue to be due on the current income.

To add the CP38 deduction to your payroll, please follow the steps below:

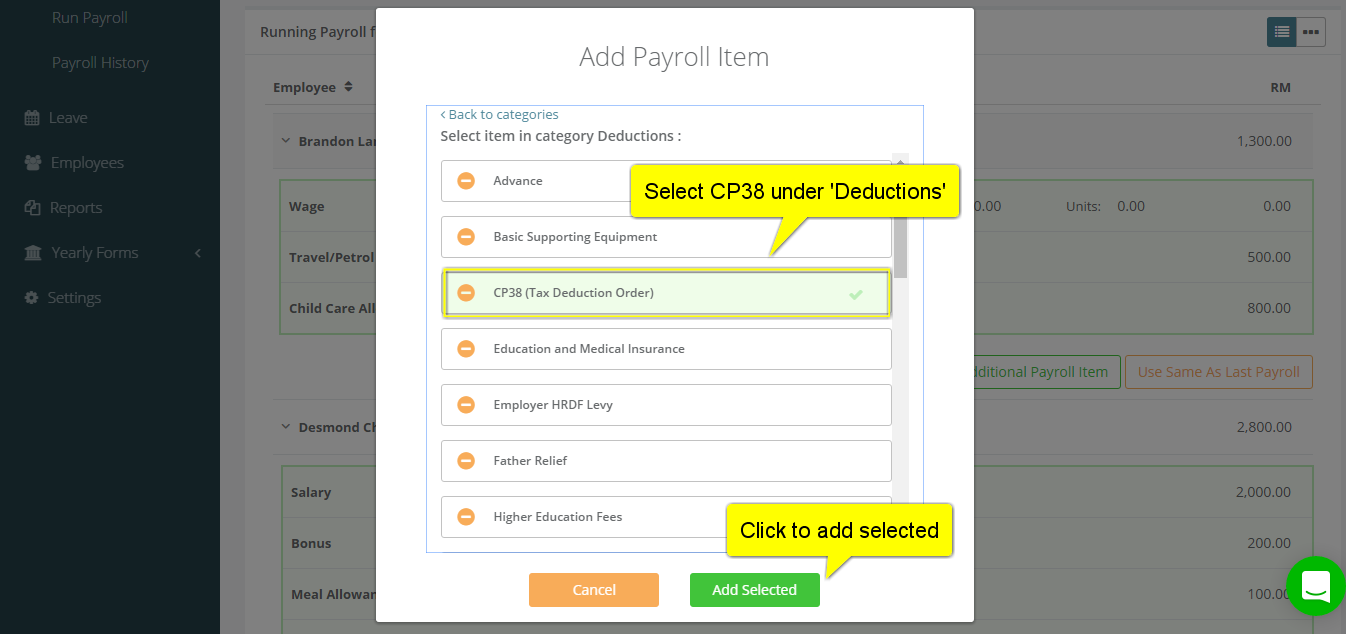

1. Add the CP38 Deductions item from Additional Payroll Items. Read how to add payroll items for further information.

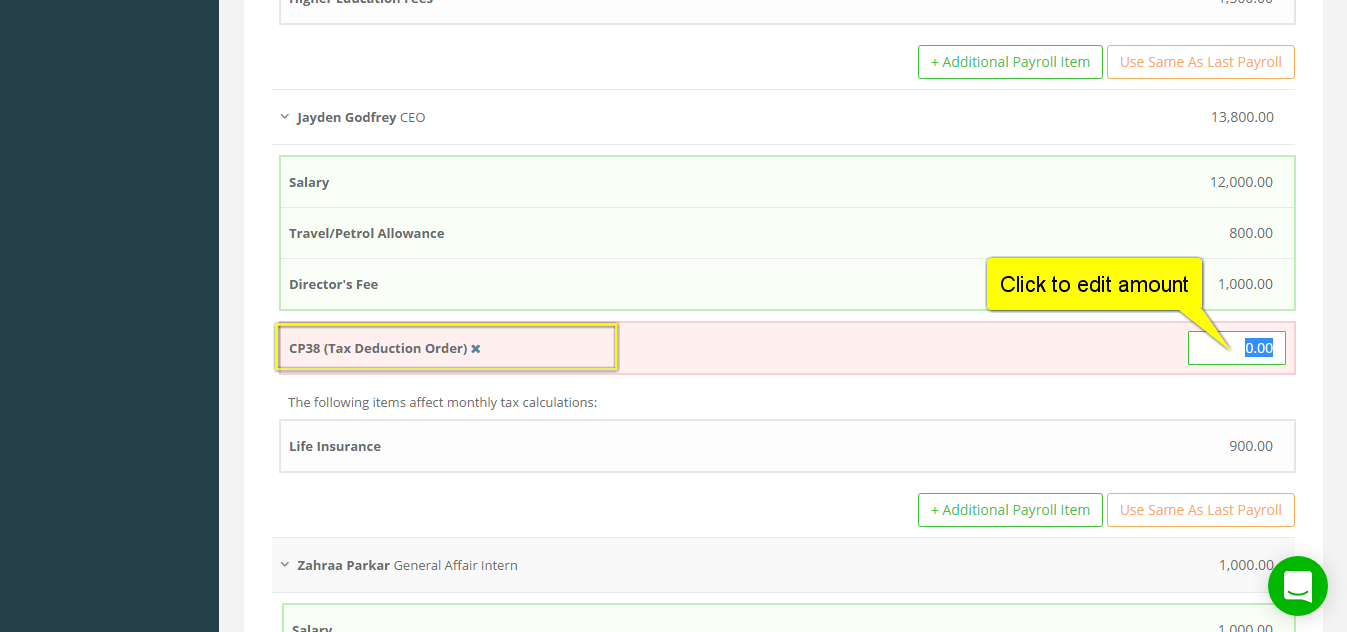

2. Edit the amount, as directed by LHDN to the employer.

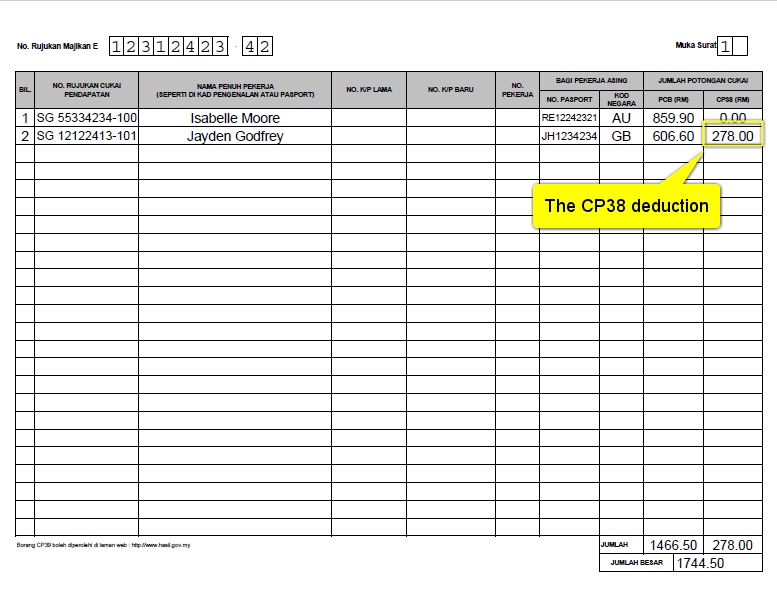

3. The amount will later be reflected in the PCB form generated by the system.

Let our payroll software calculate all your contributions. Book a demo.

This help article was compiled for version 0.10.5 of app.payrollpanda.my