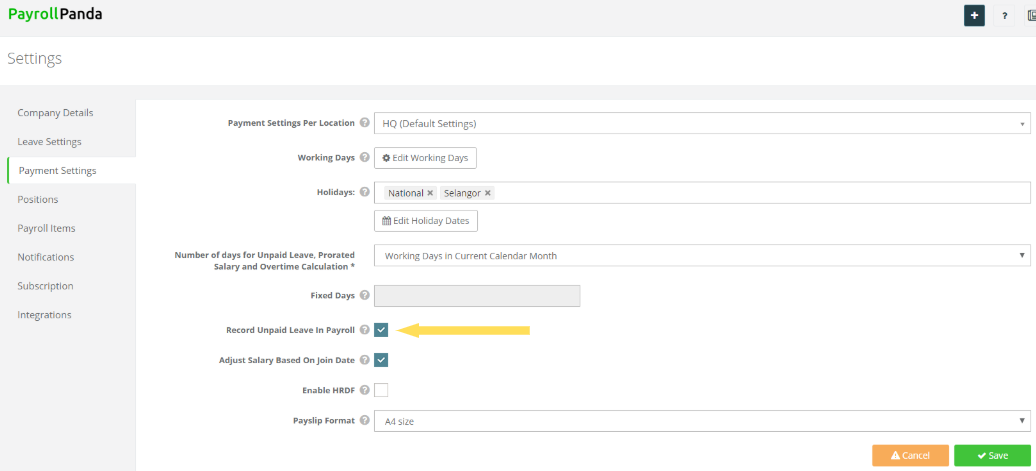

1. Go to Settings > Payment Settings and ensure “Record Unpaid Leave in Payroll” is ticked. If you wish to have your employee's salary adjusted based on their join date, please tick Adjust Salary based on Join date:

2. Under “Number of days for Unpaid Leave, Prorated Salary and Overtime Calculation” you may choose either one of three options:

- Fixed Number of Days: You may select your company’s working days for the particular payroll month.

- Working days in Current Calendar Month: Includes all ticked working days including public holidays.

- All Days in Current Calendar Month: Includes all days in the current calendar month.

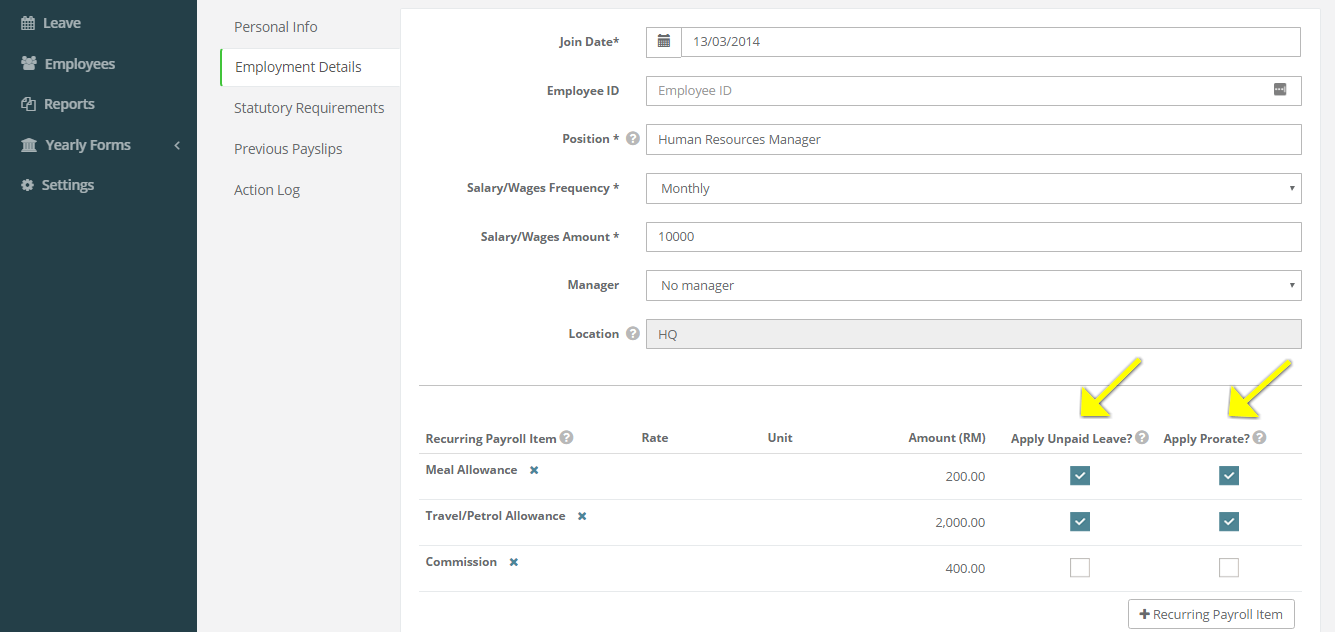

3. Don’t forget to select which recurring monthly payroll items should be affected by the Unpaid Leave and/or the Prorated Salary calculations. You may tick the relevant payroll items under each employee’s Employment Details tab.

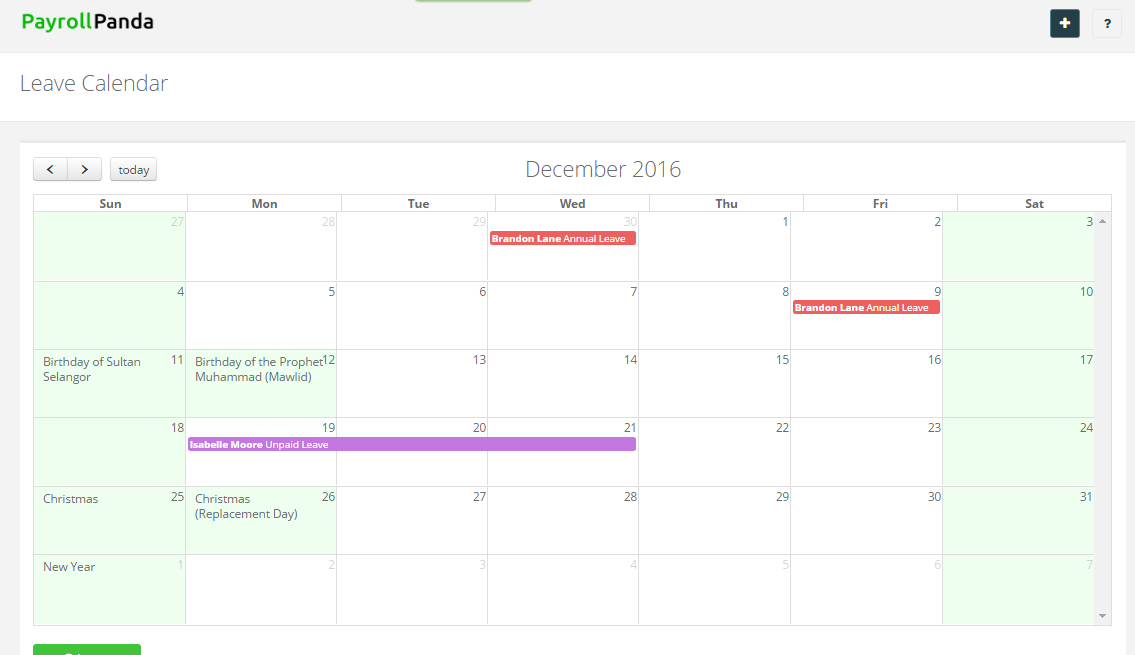

4. Under the Leave tab, you’ll be able to see a calendar with all your employees’ Unpaid, Annual and Medical Leave for each month. In our example below, you can see that employee Isabelle Moore has taken 3 days Unpaid Leave in the month of December.

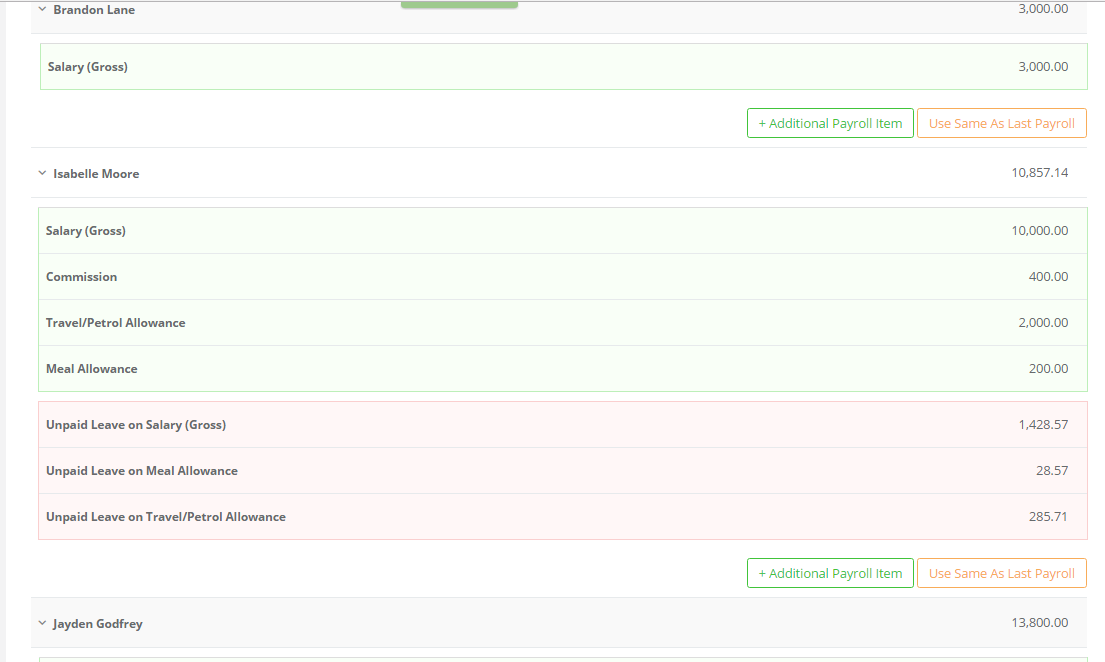

5. Once you proceed to Run Payroll, the Unpaid Leave deduction will automatically be calculated for employees who had unpaid leave recorded in the leave calendar. All recurring payroll items set to be included in the deduction will be adjusted as well. The amount depends on the Number of Working Days you chose under the Leave setting. The prorated salary for those joining or leaving your company in the middle of the month and Overtime calculation will be adjusted based on the same setting:

Please refer to our help article if you wish to manually calculate unpaid leave. To find out how to add Overtime, please click How to add overtime?

Find out more about our payroll software. You can also book a demo with us!

This help article was compiled for version 0.40.11 of app.payrollpanda.my