PayrollPanda's PCB calculation follows the formula specified by LHDN. To learn more, please head over to our help article "How is PCB calculated by PayrollPanda?"

However, if you still wish to deduct additional PCB, you can do so by adding it as an Additional Payroll Item in Step 1 of payroll (Adjustment Step).

We have 2 types of additional PCB items:

1. Additional PCB (Employment income)

This item should be used to pay additional PCB on the employee's current employment income. This additional PCB will be taken into account as previously paid PCB in the PCB calculation for the following months for the rest of the year.

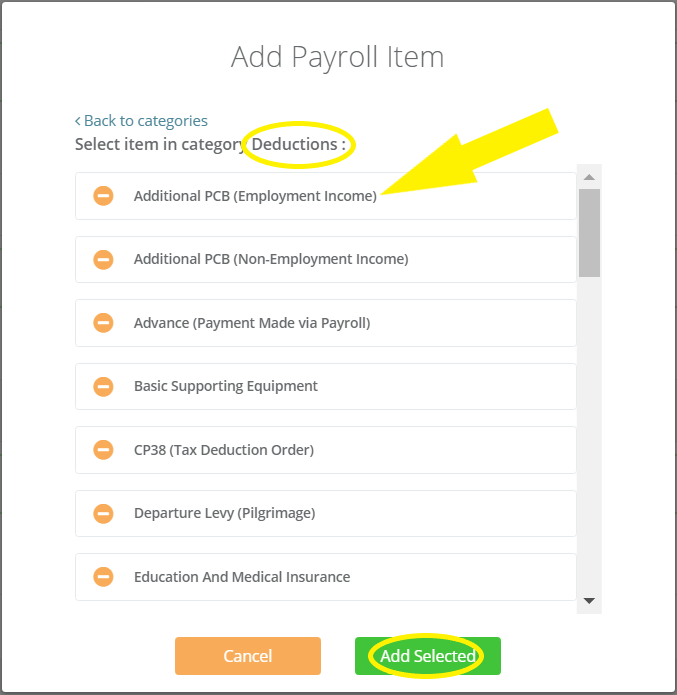

Go to Run Payroll > '+ Additional Payroll Item' > Deductions > and then select Additional PCB (Employment Income).

2. Additional PCB (Non-Employment income)

This item should be used to pay additional PCB on the employee's non-employment income or income from other employment. This additional PCB will not be taken into account as previously paid PCB in the PCB calculation for the following months.

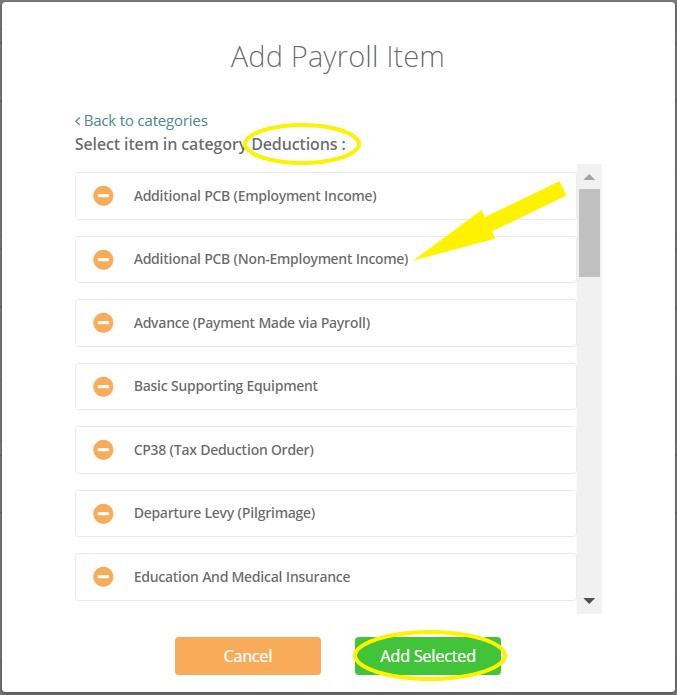

Go to Run Payroll > '+ Additional Payroll Item' > Deductions > and then select Additional PCB (Non-Employment Income).

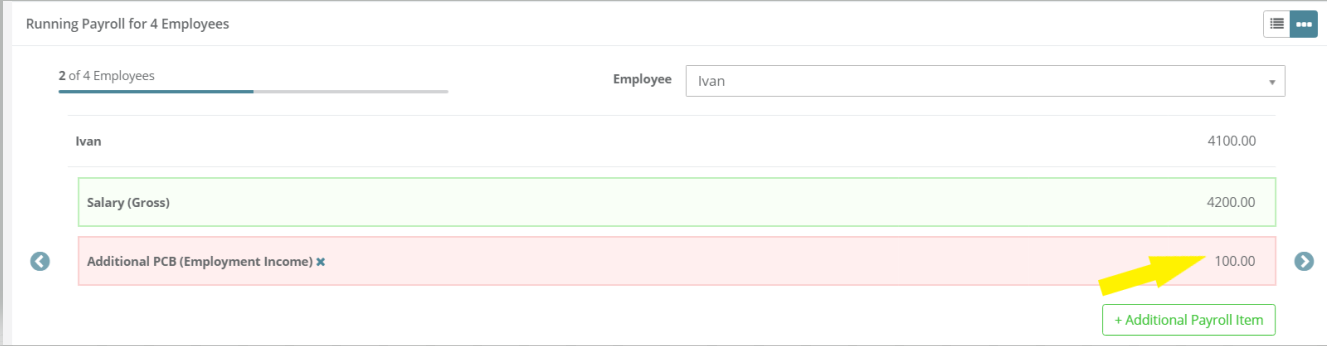

You can enter any amount you wish to add to the PCB already calculated by the system.

Let our payroll software calculate all your contributions. Book a demo.

This help article was compiled for version 1.6.1 of app.payrollpanda.my