Overview

SOCSO (Social Security Organization), also known as PERKESO (Pertubuhan Keselamatan Sosial), is a Malaysian government agency that was established to provide social security protections to employees under the Employees’ Social Security Act, 1969.

Functions of SOCSO

The functions of SOCSO are as follows:

- Registration of employers and employees

- Collection of contributions from employers and employees

- Payment of benefits to workers and/or their dependents when tragedy strikes

- Provision of physical and vocational rehabilitation benefits

- Promotion of awareness of occupational safety and health

Categories

SOCSO has two insurance schemes for its members, the "Employment Injury Scheme" which provides coverage for workplace accidents, and the "Invalidity Scheme" which provides coverage to employees who suffer from invalidity or death due to any cause and not related to their employment.

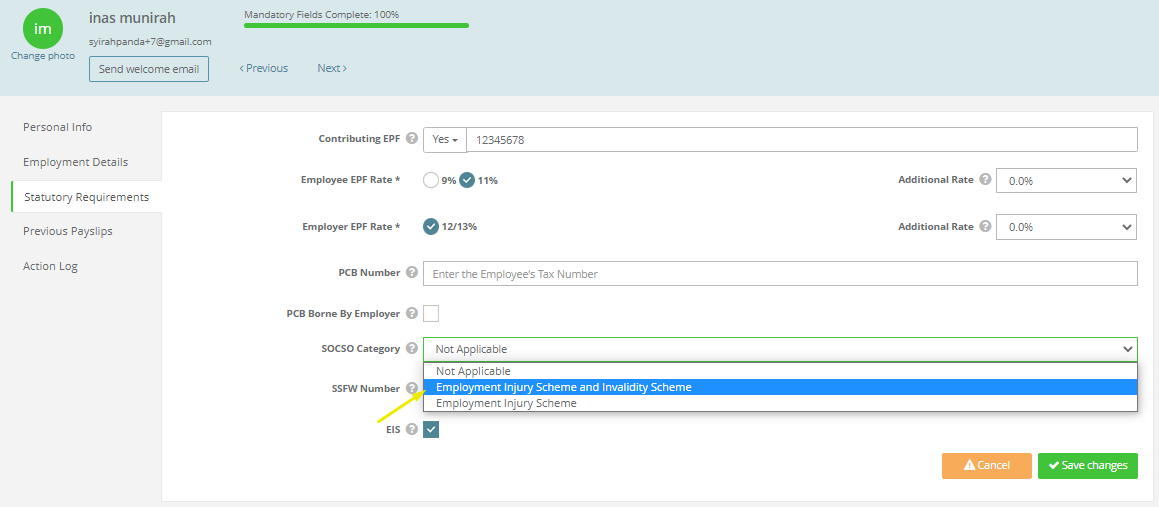

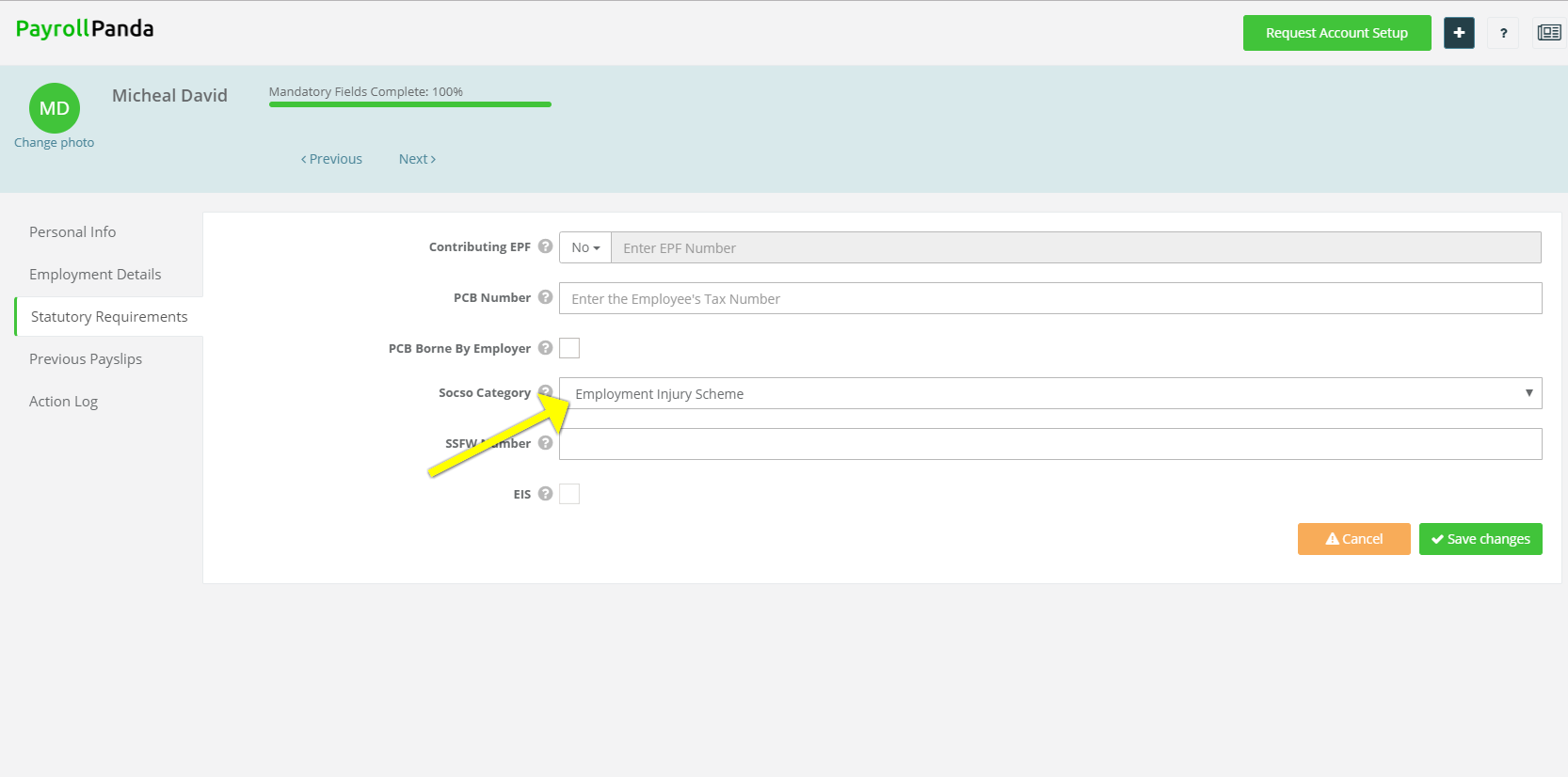

Members of SOCSO are divided into two categories. The difference between the two SOCSO categories is the coverage of its members. Members of the first category receive coverage under both schemes while in the second category, members receive coverage under the first scheme only.

You can select the relevant SOCSO category for each employee in the PayrollPanda system accordingly:

Eligibility

Contribution to SOCSO is mandatory for every Malaysian who is employed under a contract of service or apprenticeship in the private sector and/or any contractual or temporary staff of the Federal/State Government as well as Federal/State Statutory Bodies. The SOCSO contribution rate is capped at a salary of RM5,000. Please note that certain employees are not eligible for coverage by SOCSO.

For non - Malaysians who are not Permanent Residents, employer contributions only are payable under the Employment Injury Scheme.

PayrollPanda makes payroll and statutory calculations easy. Book a demo.